In another wild day on Wall Street, the Dow Jones industrial average finished below 10,000 for the first time since 2004, plunging 800 points before rebounding in the last hour to close down nearly 370. The Dow has lost more than 1,000 points in just over a week.

Earlier, some European stock markets suffered their worst one-day drops ever, following a dive in Asian markets, which fell to near five-year lows. The fall was even steeper in emerging markets such as Russia and Brazil, where markets plunged as much as 20 percent.

The stock market collapse is battering the nest eggs of millions of retirees and workers who increasingly rely on stock investments, made through mutual funds, to finance their 401(k) and other retirement accounts. The Dow is down nearly 30 percent from a year ago.

The global selloff came just three days after the passage in Congress of a $700 billion bailout plan aimed at stabilizing and restoring confidence in the US financial system. Ultimately, analysts said, investors viewed the plan as insufficient to do either. Credit markets in the United States and around the world remain all but frozen as frightened financial institutions continue to refrain from lending to each other.

Why is this happening just after we had this HUGE Bailout?

Well for one thing, The depth and breadth of the crisis is much bigger that anyone knows. The real culprit is 'creative financing'. Companies tried everything they could think of to sell their loan bundles! They knew that there were some bad apples in each bundle, but that's always the case.

This time the whole bundle was spoined by waaaay too many bad apples!

Here's a perspective from a friend's email...

"It's about the derivatives, not just bad loans!!! Trillions upon trillions worth of derivatives that no one understands the equations and models thrown out there. No one knows how deep and how much they add up to!

And they span more than across bad mortgages....credit cards, student loans, oil and gas, etc. Derivatives were used to act as insurance on so many risky loans because there was not enough insurance companies who could or who would cover so many risky investments. So the industry created derivatives "to cover" each other with their own form of insurance...but it wasn't.

It's something like - You buy a piece of bad bundled loans from me in good faith. However, there is no insurance that will cover your investment. So I, wanting to make the sale to you, come up with a plan to cover your investment if your investment goes bad. But, since I am not a true insurance company...I am an investor too...I don't keep cash on hand to cover other

companies' investments and buys from my sales. So when your investment goes bad, not to mention a bunch of my own, I have no cash on hand to cover.

All I have is people's pension plans, retirement funds, city savings, etc. in my portfolio and I am not going to cover your bad investment with my investors' investments in my company. So, I don't cover you...others don't cover me...etc. And that is where we are...except that no one really knows how many bad investments are truly out there because there were so many bizarre trades that have never happened in the past."

I think she summed it up pretty well...

But there's more to this than just bad loans.

Take for example the theory that when powerful people talk, the world listens. You've heard that before, right?

It's like if The President says something, world markets are affected, world leaders react, the World Is Listening!

So how about ol' Dingy Harry Reid saying this idiotic quote just before passing the Bailout Package...

"... One of the individuals in the caucus today talked about a major insurance company. A major insurance company -- one with a name that everyone knows that's on the verge of going bankrupt. That's what this is all about..."

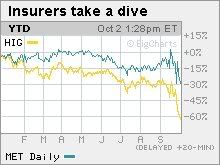

After that crack, insurance company stocks headed for the floor!

Of course ol' Harry was quick to realize that he had made an error and told us that he was sorry if he caused anybody any pain...

Sen. Reid 'regrets' insurance company comments

"...Reid's office sought to clarify the comment. His spokesman, Jim Manley, said Reid "is not personally aware" of any particular company being in trouble and has "no special knowledge" on the topic. Reid, the spokesman said, meant to refer in general terms about the financial sector and "regrets any confusion his comments may have caused."

If there's one guy that need to have his mouth sewn shut...

It's Harry Reid!

And then there's Ol' Jim Cramer.

Shoot, anybody with money in the markets is sure to watch Ol' Jims show, Mad Money, on CNBC, right?

Well, on Monday Ol' Jimmy didn't do us any favors...

Cramer: Sell It All, Right Now

“Whatever money you may need for the next five years, please take it out of the stock market right now, this week. I do not believe that you should risk those assets in the stock market right now.”

The market tanked soon after, falling more than 700 points before recovering late in the day to just under 10,000 points. Some are already calling it the "Cramer Crash."

The Fed step initially propelled the Dow Jones Industrial Average (DJI) back above the 10,000 level, breached on Monday for the first time since October 2004, but the blue-chip index was more recently off 118.04 points to 9,837.46.

Thanks Jim!

So you see, there are forces at work here that are extremely difficult to understand and control. No wonder the folks in Washington are having such a difficult time getting a handle on this crisis.

My best advice...

Stop listening to ALL those so called 'stock gurus', and don't listen to anyone from Congress!

Do your own research!

No comments:

Post a Comment